1967 Ferrari 275GTB/4 NART Spyder: the second most valuable car to sell during the 2005-6 auction season (Gooding, August 2005)

Always a sign of age, it feels surprising that once again it’s time to reflect on another year of intense activity in the classic car market whilst looking forward to see what the next 12 months hold for us.

Most top-end dealers will probably concur that 2006 was the best year they can remember since the heady late 1980s boom, and the recent launch of the authoritative new Bolaffi catalogue at the Royal Automobile Club in London threw up some interesting statistics. This guide is published annually by an Italian house best known for their reference works on the art and stamp markets, with specialist motoring expertise provided by Modenese historians Adolfo Orsi (scion of the industrialist family which owned Maserati from 1937-1971) and his longstanding colleague Raffaele Gazzi.

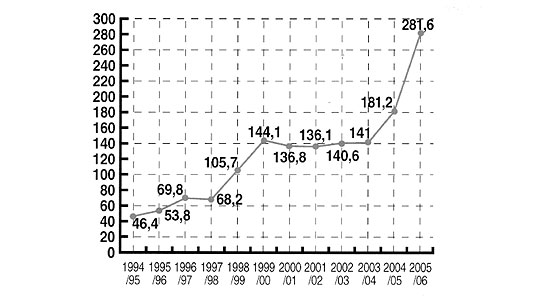

The Bolaffi catalogue is now in its 13th year which means that clear trends are starting to emerge. Consider these figures from the 2005/6 edition, for example:

* Of the 100 most valuable cars sold at auction worldwide in 2005-6, the best represented make was Ferrari with 21 cars, up from just 6 in 1993 but down from a peak of 45 in 1999.

* The second most represented car was the Cobra, with 9 cars compared to 1 in 1993 and a low of none in 2003.

* Equal second with 9 cars was Duesenberg, up from none in 1993, whilst third was Mercedes-Benz with 6 cars, compared to 17 in 2002 and 12 back in ’93.

* Bentley accounted for just 4 cars, compared to 8 in 1993 and a high of 16 in 1994.

* The average proportion of Ferraris successfully sold out of those auctioned last year was 60%, compared to 57% back in ’93 but down from a high of 74% in ’99.

* Rolls-Royce had 14 cars in the top 100 back in ’93, compared to a high of 16 in ’95, and just 1 per year in 2004/5 and 2005/6.

* The average price of Ferraris sold at auction last year was $273,000, compared to $270,000 in 2004 and $99,000 in 1994. The low point was $45,000 in 1995.

* The combined value of the cars auctioned in 2005/6 covered by Bolaffi was $281.6 million, compared to $181.2 million just a year earlier and $46.4 million back in 1994/5.

After Adolfo Orsi had presented the facts and figures he invited the heads of the leading auction house car departments, plus the undersigned (despite no longer qualifying on the first count), to comment on the market and the prospects for next year. The youthful Rupert Banner of Christie’s (who recently announced that they were ceasing UK motoring sales) commented enthusiastically on his firm’s results and predicted more of the same, with strong prices in 2007 and a growing market. My former colleague Max Girardo, back in the auction world as newly appointed head of RM’s European operations, concurred and thought the present bull market would probably remain unchanged. I expressed the view that the current rate of price inflation was unsustainable and that whilst common sense and experience had both shown that ‘the best’ was always in demand, no market rose indefinitely across the board. Rob Myers, the founder and CEO of RM who had stopped off in London to attend, shared this view and felt that certain areas of the market, notably muscle cars, had risen too fast and that pricing anomalies now existed which could not be justified. Simon Hope, genial founder and director of provincial UK auctioneers H&H, agreed. The optimism of youth versus the cautious older generation?

And the highest sale is...a bus (1950 GM Futurliner sold at Barrett Jackson, January 2006, $4.32 million). |

2005/2006 Bolaffi Catalogue |

By way of comparison, I asked two friends who are well-known and respected in the business to share their views with us:

Well-known Kensington based ‘high end’ dealer and racer Gregor Fisken was typically optimistic: “Overall, a very strong trading year. We're regularly achieving prices equal to those seen in the late 1980's and in some cases are exceeding these levels. That said, we find our clientele increasingly discerning and subsequently not all areas of the market are growing. Originality and provenance accelerate the chances of a good sale result, and there is always a strong interest in cars that are eligible for the 'blue chip' events such as the Mille Miglia, Goodwood and the Tour Auto.

“With the weakening of the dollar and a large part of the market being based in the US, there may come a point when a disagreeable exchange rate holds Americans back from making acquisitions in Europe. However, I am sure we will see European collectors taking advantage of the discounted dollar and take on stock priced in dollars. An overall scarcity of the right cars will underpin the markets present price levels and the outlook for 2007 is good.”

Back in fashion- Duesenberg SJ Convertible, 10th highest sale at $2.2 million (Gooding, August 2005)

Respected US auction entrepreneur David Gooding commented: “My sense of the market for the next year is that the extremely rare, low, production pre-war segment of the market, as well as the post war sports/racing and coachbuilt cars will continue to appreciate dramatically in value. I can cite many examples in the past few months where I have brought record price offers to clients, only to be refused because they love their cars. We will see a few cars change hands in the $20 million range soon….

“However, I cannot understand or support the sales results of many muscle car prices recently. Plymouths should not be worth three to four times more than a great open Ferrari of the same period!! New hotrods that were built in the last 6 months are not all automatically worth the $400,000-500,000 asking price. I personally do not buy into it. Some rationality in these two segments of the market would be healthy for all.”

My own views are similar and whilst the Bolaffi statistics show dramatic rises in value over little more than a decade (consider the six-fold increase in the value of sold cars covered by the guide), they also show that different cars come into - and fall out of - fashion. Bentley and Rolls-Royce were for years the mainstay of collecting on both sides of the Atlantic, whereas now they have been superseded by ‘racier’ marques such as Ferrari and even hybrid V8 engined upstarts (no names). The rarity and mystique of the Duesenberg, however, has seen a new generation of collectors begin to chase them. On the Ferrari front, the statistics show that the percentage of ‘top 100’ cars sold compared to those offered has dropped from a peak in 1999 when, in my opinion, vendors expectations were still in line with those of buyers’ rather than often ahead of them. I don’t think it’s a coincidence that the number of Ferraris in the top 100 cars sold at auction (and this is an important distinction from those sold privately) is less than half as many as in 1999, reflecting that speculative Ferrari sellers probably know their prices are high and don‘t want to risk a public ‘no sale’, and they may not think they need to with so many private buyers around now anyway.

‘Supersnake’- the twin supercharged, 7 litre, automatic Shelby Cobra starring at Barrett Jackson next month

With the usual January auction madness looming next month in Arizona, we’re already hearing huge numbers bandied about for a variety of improbable motor cars. ‘Five million bucks’ is said to be the estimate on ‘The Cobra to End All Cobras’, the twin supercharged, 800bhp, three speed automatic (!!!) 427 Cobra built in 1966 for Carroll Shelby and on offer at Barrett Jackson, who this year shifted $102 million of heavy metal at their Scottsdale extravaganza. Not to be outdone when it comes to understated titles, rival firm RM offer ‘The King Kong of Muscle Cars’, which in case you were wondering is a purple 1971 Plymouth Hemi Barracuda Convertible. “One of 11 built and the only one featuring the rare color matching ‘Elastomeric’ bumpers”, they inform us. Enthusiasts of Elastomeric bumpers (no, I don’t know either) will have to stump up at least $2 million to own this interesting conversation piece, which has covered just 282 miles from new, presumably because it’s so rewarding to drive.

'The King Kong of Muscle Cars’: well-endowed 1971 Plymouth Hemi ‘Cuda coming up soon at RM.

The European end of year sales showed just how few good quality cars are available on the market over here: Bonhams’ results at Olympia were buoyed by cars from the Rosso Bianco collection, acquired by a friend of the company earlier this year, but only one lot was hammered at over £200,000. Christie’s of course were absent from this month’s sales calendar, but all eyes will be focused on their Retromobile sale in February. This year their Parisian sale results were average, but for 2007 they have consigned the most expensive car to be offered at auction since Bonhams took a 1962 Ferrari 250GTO to Gstaad back in 2000 (yes, I admit, we took it home again afterwards too).

But is Christie’s star Lot actually saleable? There’s no doubting that a pre-war Grand Prix Auto Union is about as exciting as motor cars get, symbolic not just of the ground breaking, Nazi backed technology of the era but also of a rapidly changing world which was soon to be transformed forever. But single seaters are notoriously hard to sell, due to limited opportunities for use, demanding maintenance (in this case, imagine 485bhp, 12 cylinders, twin supercharging and just four similar cars in existence- don’t bother calling the owners club for tips or parts…) and the demands they place on drivers too. They didn’t call Germany’s pre-war pilotes ‘The Titans’ for nothing. Christie’s have announced a pre-sale estimate of €8-12 million on this, in Scottsdale-speak presumably ‘The King Kong of Grand Prix Cars to End all Grand Prix Cars’…never mind. The world record for a car at auction, set almost 20 years ago by Robert Brooks when still at Christie’s, stands at £5.5 million (that’s €8.1 million at today’s exchange rate). I wouldn’t be surprised if it stands for a little bit longer, but I wish Christie’s well. If they can pull it off, it’ll feel like the bull market of the late 1980s all over again. Just without the red braces.

1939 Auto Union D-Type to be auctioned by Christie's at Paris Rétromobile 2007

The 2005-6 Bolaffi Catalogue costs €40 plus postage and may be ordered from [email protected]

Words: Simon Kidston

Photos: Gooding & Co./RM/Bolaffi/Barrett Jackson/Christie's

Simon Kidston's company, Kidston SA, was formed in 2006 with the benefit of almost two decades experience at the forefront of the collectors' car world. Services available include; Rapid financing for acquisitions, specialist insurance solutions, objective, confidential advice on buying and selling including the latest market valuations, and Private Sales Portfolios, the very latest of which can be see on the Classic Driver Car Database.

|

Kidston S.A.

7 Avenue Pictet de Rochemont, 1207 Geneva, Switzerland Tel:+41 22 740 1939 Fax:+41 22 740 1945 Email: [email protected] Website: www.kidston.com |

ClassicInside - The Classic Driver Newsletter

Free Subscription!